In a fiery rally held in Wildwood, New Jersey, former President Donald Trump vowed to implement sweeping tax cuts across all economic classes if reelected for a second term. Diverging sharply from the tax hike proposals put forth by his successor, President Joe Biden, Trump promised a comprehensive tax relief plan that would benefit the “middle class, upper class, lower class, and business class” alike.

Addressing a crowd of fervent supporters, Trump emphasized his commitment to bolstering the economy through tax reform. He framed his proposal as a stark alternative to Biden’s agenda, positioning himself as the champion of economic prosperity for all Americans. The pledge to deliver tax cuts resonated strongly with his base, many of whom view tax reduction as a cornerstone of his economic policy.

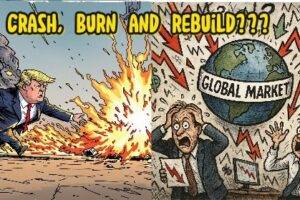

Trump’s announcement underscores the sharp ideological contrast between the two major parties regarding fiscal policy. While Biden has advocated for tax increases on corporations and high-income earners to fund ambitious social programs and infrastructure investments, Trump’s approach prioritizes stimulating economic growth through deregulation and tax relief.

If realized, Trump’s proposed tax cuts would mark a continuation of his administration’s efforts to stimulate economic growth through fiscal policy. During his first term, Trump successfully pushed through a significant overhaul of the tax code, resulting in widespread tax reductions for individuals and businesses. His promise of further tax cuts in a potential second term signals his intent to maintain a pro-business agenda aimed at sustaining economic expansion.

Potential Impact and Controversy Surrounding Trump’s Tax Plan

While Trump’s pledge to enact tax cuts across the board may energize his base, it is likely to spark debate and scrutiny from critics and policymakers. The potential ramifications of such a tax policy on government revenue, income inequality, and the overall economy are subjects of contention.

Proponents of Trump’s tax cuts argue that reducing the tax burden on individuals and businesses would stimulate investment, job creation, and consumer spending, thereby fueling economic growth. They contend that lower taxes would incentivize entrepreneurship and innovation, leading to a more dynamic and competitive economy.

However, critics raise concerns about the distributional effects of Trump’s proposed tax cuts, questioning whether they would exacerbate income inequality by disproportionately benefiting the wealthy. They also warn of potential revenue shortfalls that could strain government finances, particularly in light of existing budget deficits and mounting public debt.

Moreover, the efficacy of tax cuts as a means of stimulating economic growth remains a subject of debate among economists. While some studies suggest that tax reductions can spur short-term economic activity, others argue that the long-term impact may be more limited, particularly if not accompanied by corresponding spending cuts or revenue-raising measures.

As the debate over tax policy continues to unfold, Trump’s pledge to pursue additional tax cuts in a potential second term is poised to be a central issue in the upcoming presidential election, shaping the economic vision and priorities of the competing candidates.

Biden’s Tax Plan vs. Trump’s Ambiguity

As the 2024 presidential election draws near, the focus is not only on the candidates’ campaign promises but also on the impending tax negotiations awaiting the next administration. With the personal income tax cuts from Trump’s 2017 law scheduled to expire in 2025, the stakes are high for both candidates vying for the White House. Democratic nominee Joe Biden has been vocal about his intentions to eliminate tax cuts benefiting households earning more than $400,000 while raising levies on wealthy Americans and large corporations. This move aligns with Biden’s campaign rhetoric of addressing income inequality and funding social programs through increased taxation on the affluent.

In contrast, the incumbent President Trump, yet to release a formal tax plan, continues to advocate for across-the-board tax cuts, including for top earners and businesses. Trump’s recent comments underscore his commitment to reducing taxes, a cornerstone of his economic policy. Despite lacking a detailed blueprint, Trump’s economic advisers are exploring various avenues to further decrease levies, including the consideration of a flat tax. The president’s deliberation on extending personal tax cuts while maintaining the corporate tax rate at 21% reflects a nuanced approach to tax policy, balancing the interests of different income groups and businesses.

Expiring Provisions and Criticisms

Aside from the expiration of personal income tax cuts, other provisions set to lapse at the end of next year include restrictions on the estate tax and a deduction for business owners. These aspects of the tax code have faced criticism for disproportionately benefiting high-earners and exacerbating wealth inequality. The estate tax, in particular, has been a contentious issue, with proponents arguing for its preservation as a tool for redistributing wealth, while opponents view it as punitive to small business owners and family farms.

Similarly, the deduction for business owners has come under scrutiny for its perceived favoritism towards wealthy entrepreneurs, prompting calls for reform to ensure a fairer distribution of tax benefits. The impending expiration of these provisions highlights the urgency for comprehensive tax reform, with both candidates facing pressure to address these issues in their respective platforms. As the nation awaits the outcome of the election, the trajectory of tax policy in 2025 remains uncertain, with implications for economic growth, income distribution, and fiscal sustainability.

By examining the divergent approaches of Biden and Trump towards tax policy and the critical provisions set to expire, it becomes evident that the next administration will confront formidable challenges in navigating the complex terrain of taxation. With the deadline for action looming, the electorate must scrutinize the candidates’ proposals and assess their potential impact on the economy and society as a whole. As the nation stands at a crossroads, the choices made in 2024 will reverberate for years to come, shaping the trajectory of fiscal policy and economic prosperity

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.