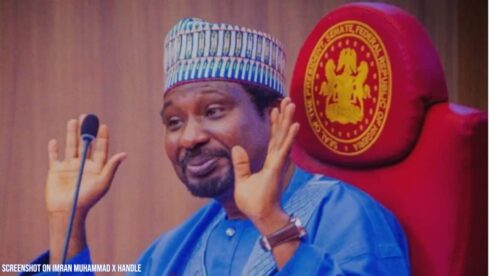

Senator Barau Jibrin expressess that the Nigerian Senate has moved forward with proposed tax reform bills, passing them for a second reading to pave the way for comprehensive national input. Speaking to BBC Hausa, Deputy Senate President, Senator Barau Jibrin, emphasized the importance of public engagement in shaping these bills. Senator Barau Jibrin noted that this step is crucial for gathering insights from tax experts, stakeholders, and ordinary Nigerians to create equitable and effective legislation.

According to Senator Barau Jibrin, the reforms aim to modernize Nigeria’s tax system, making it more transparent, efficient, and aligned with global best practices. Senator Barau Jibrin underscored the Senate’s commitment to inclusivity, ensuring that the diverse perspectives of Nigerians are reflected in the final versions of the bills. This inclusive approach is designed to foster trust and encourage compliance among taxpayers.

Senator Barau Jibrin: Creating an Inclusive Tax Reform Process

The Senate’s decision to open the tax reform process to public scrutiny underscores its dedication to participatory governance. By inviting inputs from tax professionals, business leaders, and civil society organizations, lawmakers aim to ensure that the reforms address the specific needs of various economic sectors. This approach is expected to create a fairer tax structure that supports Nigeria’s economic growth.

Senator Barau Jibrin explained that the process is also an opportunity to educate citizens on the importance of taxation in national development. Senator Barau Jibrin called on Nigerians to engage actively during the public consultation period, emphasizing that their contributions could influence critical aspects of the bills, such as tax rates, exemptions, and compliance mechanisms.

Addressing Nigeria’s Revenue Challenges

The tax reform bills are part of a broader effort to tackle Nigeria’s persistent revenue challenges. With oil revenues declining and an expanding budget deficit, the government is seeking to diversify its income sources by improving tax collection and compliance. The reforms aim to close loopholes, broaden the tax base, and reduce dependence on volatile oil revenues.

Experts argue that modernizing the tax system is essential for sustainable development. The proposed bills are expected to introduce digital tools and data analytics for better tax administration, reducing evasion and improving efficiency. This strategy aligns with global trends and aims to position Nigeria as a competitive economy in the international arena.

Balancing Economic Growth and Taxation

One of the primary goals of the tax reform bills is to strike a balance between boosting government revenue and fostering economic growth. The Senate has assured the public that the reforms will not impose undue burdens on businesses or individuals. Instead, they aim to create a tax environment that encourages investment and job creation.

Senator Barau Jibrin emphasized that the proposed legislation would include provisions to support small and medium-sized enterprises (SMEs), which are vital to Nigeria’s economy. By introducing incentives and streamlining tax processes, the reforms are expected to reduce administrative bottlenecks and promote compliance, ultimately benefiting both the government and taxpayers.

Challenges and Criticisms of the Proposed Reforms

Despite the potential benefits, the tax reform bills have sparked debates and criticisms from various quarters. Some stakeholders have expressed concerns over the possibility of increased tax rates, arguing that such measures could further burden struggling businesses and households. Others have questioned the government’s ability to enforce compliance effectively without addressing systemic corruption.

The Senate has reassured critics that their concerns will be addressed during the public consultation phase. Senator Barau Jibrin stressed that the reforms are not intended to stifle economic activities but to create a more equitable system that benefits all Nigerians. He called on detractors to present constructive feedback to ensure the bills achieve their intended objectives.

Next Steps in the Tax Reform Journey

With the tax reform bills advancing to the consultation stage, the Senate has set a timeline for public hearings and expert reviews. These sessions will allow Nigerians to voice their opinions and propose amendments before the bills are finalized. This collaborative process is expected to enhance the credibility and acceptance of the reforms.

Senator Barau Jibrin urged citizens to seize this opportunity to contribute to national development by participating in the process. He highlighted the importance of collective action in building a robust tax system that supports infrastructure development, social services, and economic stability. The Senate remains optimistic that the reforms will lay the foundation for a prosperous and self-reliant Nigeria.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.