Nigeria: President Bola Tinubu has submitted a proposal to the Senate, seeking approval for a substantial loan amounting to $8.6 billion and an additional €100 million. These funds are specifically earmarked for crucial national projects across various sectors of the economy. This announcement came to light during the Senate’s plenary session on Tuesday, relayed by Senate President Godswill Akpabio.

Purpose and Allocation of Funds

Tinubu emphasized that these funds are part of the federal government’s pre-approved 2022-2024 external borrowing plan, initially sanctioned during former President Muhammadu Buhari’s administration. He underlined that the selection of projects to be funded by this loan was meticulously conducted, accounting for economic evaluations and their potential contributions to the nation’s development.

The proposed projects encompass a wide spectrum, spanning infrastructure, agriculture, health, water supply, roads, security, and employment generation. Tinubu underscored that these projects were carefully chosen based on their potential socio-economic impacts, such as employment generation and skills acquisition, thereby highlighting their significance in fostering the country’s growth.

Senate’s Role in National Progress

President Tinubu, in his letter to the Senate, emphasized the importance of prompt approval by the National Assembly. He stressed that the past administration had greenlit the borrowing plan during the Federal Executive Council meeting in May 2023. Highlighting the urgency and critical nature of these projects, Tinubu urged the Senate to consider and approve the abridged borrowing plan for 2022-2024, emphasizing the necessity to restore the nation to a state of normalcy.

Economic Evaluation and Social Development Impact

The crux of Tinubu’s request lies in the rigorous economic evaluations and the projected contributions of these projects towards Nigeria’s socio-economic advancement. The comprehensive borrowing plan aligns with the government’s goals of fostering development, job creation, and skill enhancement. The borrowing proposal, when approved, is poised to facilitate the government in fulfilling its obligations towards the Nigerian populace.

In summary, President Tinubu’s request for the Senate’s approval of an $8.6 billion and €100 million loan targets multifaceted national projects crucial for Nigeria’s advancement. The emphasis on economic evaluations, socio-economic contributions, and the urgency of project implementation underscores the significance of this proposal in bolstering the nation’s growth and development. The onus now rests on the Senate to deliberate and decide on this pivotal initiative for Nigeria’s future prosperity.

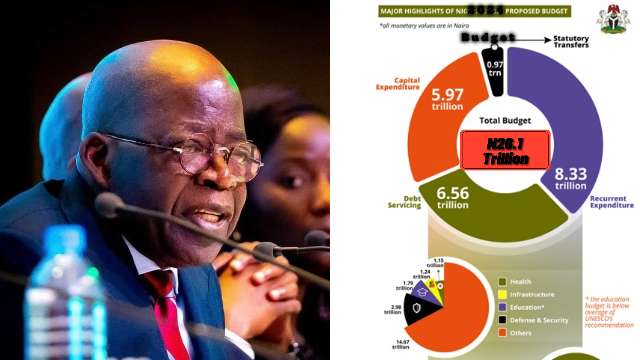

Nigeria’s Public Debt Skyrockets to N87.38 Trillion: Causes and Implications

Nigeria’s Debt Management Office (DMO) has released its alarming report on the country’s escalating public debt, soaring to a staggering N87.38 trillion in the second quarter of 2023. This unsettling figure marks a 75.29 percent surge, a substantial increase of N37.53 trillion from the N49.85 trillion recorded at the close of the first quarter this year. The pronounced spike in debt stems primarily from the N22.71 trillion ways and means advances sought by the federal government from the Central Bank of Nigeria (CBN).

The latest DMO report underscores that this substantial debt accumulation amalgamates both domestic and external debts of the Federal Government, the thirty-six states, and the Federal Capital Territory. The most significant augmentation to this debt stock came from the incorporation of the N22.712 trillion securitized FGN’s Ways and Means Advances, which the federal government received approval to securitize from the national assembly in May 2023.

The Ways and Means Advances from the CBN, initially intended for short-term financial exigencies, witnessed an unprecedented expansion. This growth was catalyzed by a modification in the CBN Act, as requested by the former President, Muhammadu Buhari, elevating the loan issuance cap from five percent to 15 percent of the preceding year’s federal government revenue. The purpose behind this alteration was to curtail interest payments on the principal amount and elongate its repayment period.

Breakdown of Debt Composition and Debt Service Costs

Out of the N87.38 trillion total public debt, the DMO report discloses that domestic debt constitutes a significant 61.95 percent share, amounting to N54.13 trillion. In contrast, the external debt contributes N33.25 trillion, representing 38.05 percent of the total debt. Comparing these figures with the Q1 statistics – N30.21 trillion for domestic and N19.64 trillion for external debt – reveals a substantial escalation.

Despite the apprehension surrounding the skyrocketing debt, the DMO remains optimistic. It anticipates that ongoing administrative reforms and potential suggestions from the Fiscal Reform and Tax Policies Committee could positively influence debt management strategies. The anticipated outcome is an improvement in debt sustainability, albeit contingent upon the effective implementation of these recommended reforms.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.