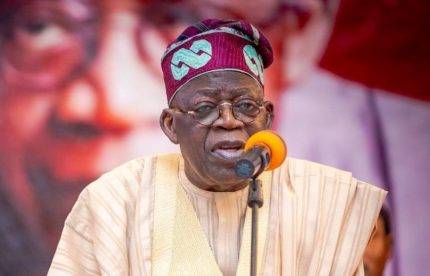

President Bola Tinubu made a significant stride in Nigerian education reform as he signed into law the Nigeria Education Loan Fund (Student Loans) (Access to Higher Education) (Repeal and Re-enactment) Bill, 2024 on Wednesday, April 3, 2024. This landmark legislation promises to revolutionize access to higher education and foster skill development among Nigerian students and youths.

Under the newly enacted law, every Nigerian student will have access to sustainable funding for higher education, eliminating financial barriers that often impede academic pursuits. This move is expected to enhance inclusivity and diversity within the higher education landscape, ensuring that talented individuals from all socio-economic backgrounds have the opportunity to pursue their academic dreams.

Moreover, the Act emphasizes the importance of functional skill development, aligning educational objectives with the needs of the job market. By providing avenues for students to acquire practical skills alongside theoretical knowledge, the legislation aims to produce graduates who are well-equipped to meet the demands of a rapidly evolving economy. This shift towards a more skills-oriented approach is poised to enhance Nigeria’s competitiveness on the global stage and bolster its workforce with highly skilled professionals.

Resolving Past Challenges: The Genesis of the Amended Act

The decision to amend the previous Nigeria Education Loan Fund, 2023, stemmed from a series of challenges plaguing its implementation. Key issues included governance and management concerns, ambiguity regarding the purpose of loans, eligibility criteria for applicants, the application process, repayment terms, and loan recovery mechanisms. These deficiencies hampered the effectiveness of the legislation in facilitating access to higher education for Nigerian students.

Addressing Shortcomings: Key Amendments in the New Act

Under the newly enacted Student Loans (Access to Higher Education) (Repeal and Re-enactment) Act, 2024, significant strides have been made to rectify the shortcomings of its predecessor. The amendments introduced are aimed at enhancing the accessibility, efficiency, and effectiveness of the student loan system. The following provisions stand out as pivotal in reshaping the landscape of higher education financing in Nigeria:

Establishing the Nigeria Education Loan Fund (NELFUND)

The creation of Nigeria Education Loan Fund as a distinct legal entity endowed with the capacity to litigate and be litigated against signifies a crucial step towards institutionalizing a robust framework for administering student loans. By empowering Nigeria Education Loan Fund to acquire, manage, and dispose of assets, including immovable property, the Act ensures the Fund’s ability to enter into contractual agreements, including loan arrangements, and enforce repayment obligations.

Empowering Nigeria Education Loan Fund to Provide Comprehensive Financial Support

The Act expands the scope of financial assistance available to qualified Nigerian students, encompassing not only tuition fees but also ancillary expenses such as institutional charges and maintenance costs. By diversifying its funding sources and operational modalities, Nigeria Education Loan Fund aims to broaden access to higher education, vocational training, and skill acquisition programs, thereby fostering human capital development across the nation

Instituting Transparent Governance and Management Structures

A pivotal reform introduced by the Act involves the delineation of governance and management functions within Nigeria Education Loan Fund. The establishment of a board of directors, comprising representatives from relevant government ministries, regulatory agencies, educational institutions, student bodies, and the private sector, underscores a commitment to inclusive decision-making and stakeholder engagement. Concurrently, the appointment of a dedicated management team, headed by a managing director and executive directors, ensures the efficient day-to-day operations of the Fund.

Ensuring Financial Viability and Sustainability

he Act delineates a clear financial framework for Nigeria Education Loan Fund, including the establishment of a General Reserve Fund funded by a percentage of taxes, levies, and duties collected by the Federal Inland Revenue Service. This financial mechanism not only guarantees a stable revenue stream for loan disbursements but also safeguards the Fund’s long-term viability by earmarking resources for operational expenses and strategic initiatives aligned with its objectives.

Refining Eligibility Criteria

Furthermore, the Act introduces revisions to the eligibility criteria for loan applicants, thereby streamlining the selection process and ensuring that financial assistance is targeted towards individuals most in need of support. By adopting more nuanced eligibility parameters, Nigeria Education Loan Fund aims to optimize the allocation of resources and maximize the impact of its lending programs on educational attainment and socio-economic mobility.

The amendments introduced under the Student Loans (Access to Higher Education) (Repeal and Re-enactment) Act, 2024, herald a new era of transparency, inclusivity, and effectiveness in the provision of student financial aid in Nigeria. By addressing the inherent deficiencies of the previous legislative framework and embracing innovative approaches to governance, funding, and eligibility assessment, Nigeria Education Loan Fund seeks to empower aspiring students, alleviate financial barriers to education, and catalyze national development efforts through enhanced human capital formation.

Removal of Financial and Guarantor Requirements

In a significant move aimed at expanding access to higher education, the Nigerian government has announced sweeping amendments to the Nigeria Education Loan Fund, eliminating the family income threshold and guarantor requirements previously hindering students from applying for loans. Under the revised guidelines issued by the Fund, Nigerian students will now have the opportunity to apply for loans without being subjected to stringent financial criteria or the need for guarantors. This bold step reflects the government’s commitment to fostering educational opportunities for all citizens, regardless of their socio-economic background.

The removal of these barriers marks a paradigm shift in the approach to student financing in Nigeria. By allowing students to access loans based on their individual merits and identities, the government aims to empower a new generation of learners to pursue higher education and fulfill their academic aspirations. Moreover, this measure aligns with global best practices in student financing, where the focus is on enabling equal access to education for all, irrespective of financial constraints. As the Fund streamlines its application and verification processes, it is poised to witness a surge in loan applications, opening doors of opportunity for countless students across the country.

Justice and Fairness Provision Ensures Equitable Distribution of Loans

Another notable provision introduced in the amended Nigeria Education Loan Fund is the establishment of a justice and fairness provision mandating the Board to ensure a minimum national spread of loans approved and disbursed annually. This provision seeks to address concerns regarding regional disparities in loan disbursement and ensures that students from all parts of the country have equitable access to educational financing. By prioritizing the distribution of loans based on national spread, the government aims to promote inclusivity and diversity within the education sector, thereby fostering a more cohesive and integrated society.

The implementation of this provision underscores the government’s commitment to fostering national unity and cohesion through educational policies that promote fairness and equity. By ensuring that loans are disbursed across different regions, the government seeks to harness the diverse talents and potential of Nigeria’s youth, regardless of their geographical location. This strategic approach not only enhances access to education but also contributes to the overall socio-economic development of the country by equipping students with the skills and knowledge needed to drive progress in their respective communities.

Repayment and Loan Forgiveness Provisions

In addition to enhancing access to education, the amended Nigeria Education Loan Fund also introduces provisions related to loan repayment and forgiveness, aimed at alleviating the financial burden on beneficiaries. One key provision stipulates that loan recovery efforts will not commence until two years after the completion of the National Youth Service Programme, providing beneficiaries with a grace period to secure employment and stabilize their financial situation before repayment obligations begin. Furthermore, beneficiaries facing financial hardship may request an extension of enforcement action by providing a sworn affidavit indicating their employment status and income situation.

Moreover, the Act incorporates a provision for loan forgiveness in cases of death or circumstances beyond the beneficiary’s control, such as acts of God causing an inability to repay. This compassionate provision acknowledges the unforeseen challenges that beneficiaries may encounter during their loan repayment period and offers a safety net to alleviate their financial burden in times of crisis. By prioritizing the welfare of beneficiaries and recognizing the unpredictable nature of life, the government demonstrates its commitment to supporting students throughout their educational journey and beyond.

The amendments to the Nigerian Student Loan Act represent a significant milestone in the country’s quest to promote access to education and empower its youth. By removing financial barriers, ensuring equitable distribution of loans, and introducing provisions for repayment and forgiveness, the government reaffirms its commitment to investing in the future of Nigeria and building a skilled workforce capable of driving sustainable development. As these reforms take effect, they are poised to transform the educational landscape of the country, unlocking opportunities for millions of students and paving the way for a brighter, more prosperous future.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.