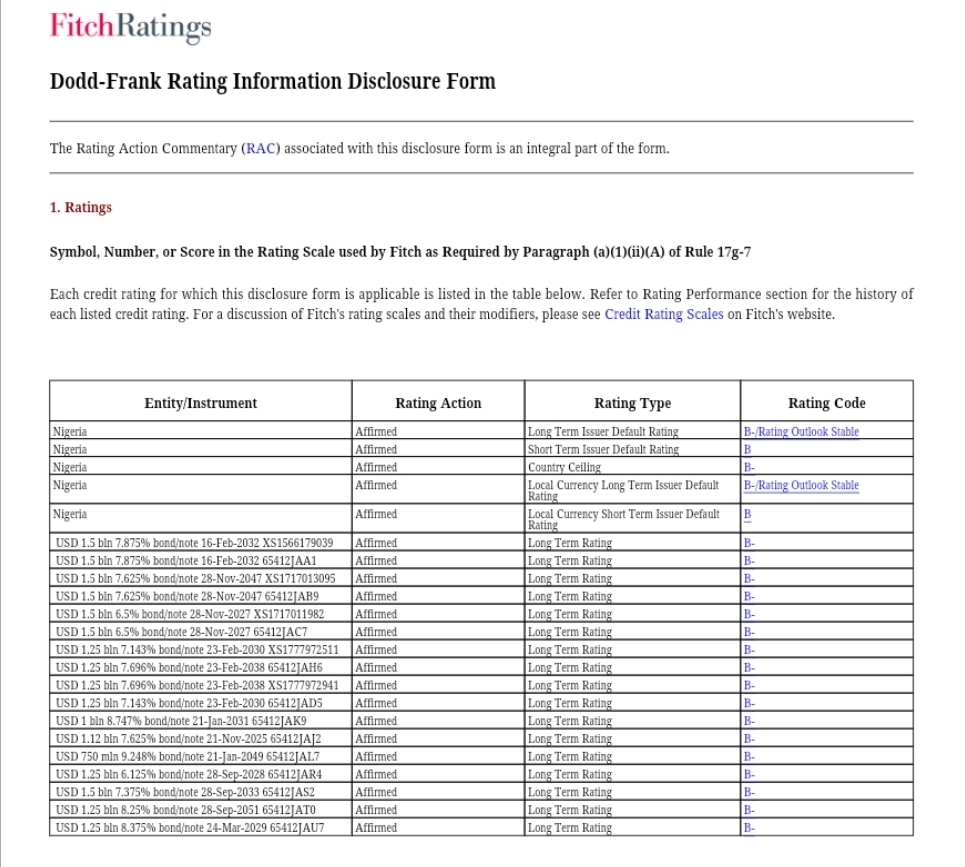

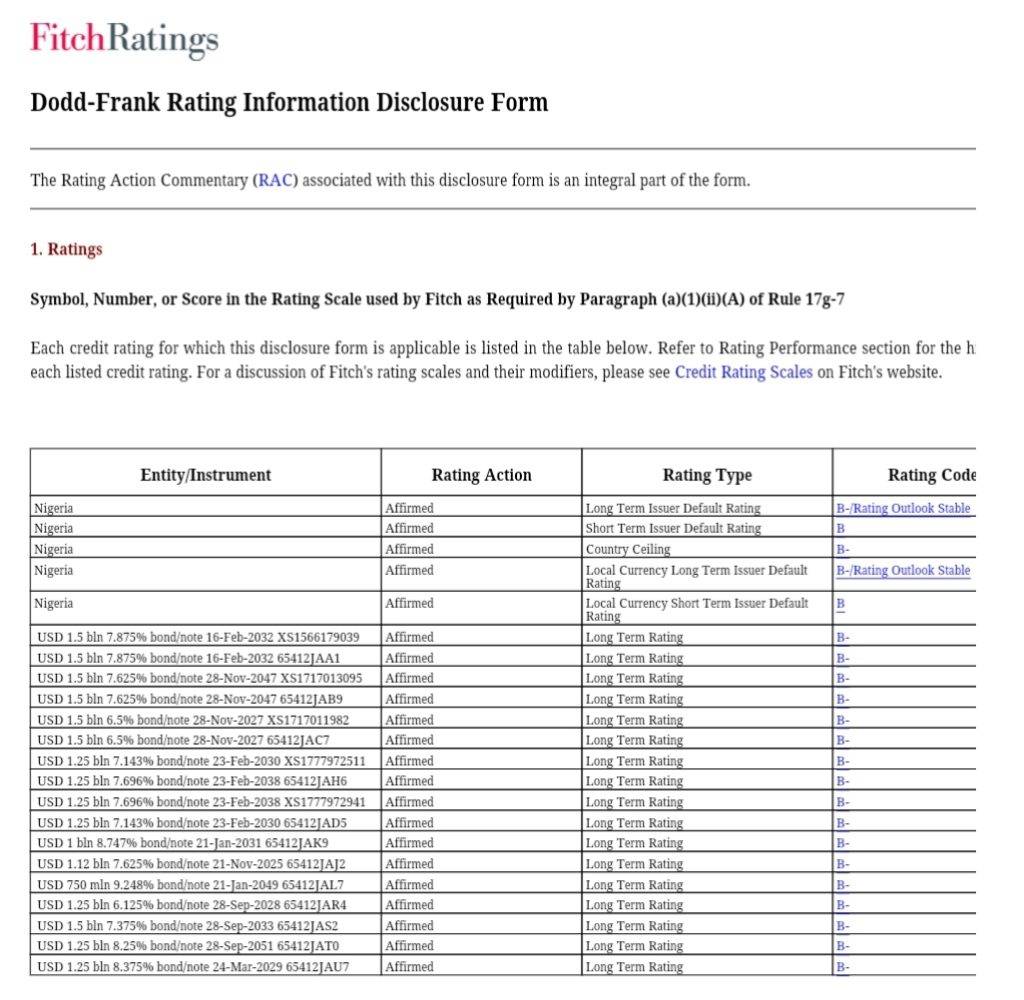

Fitch Ratings, a leading global credit rating agency, has affirmed Nigeria’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘B-‘ with a Stable Outlook. This rating decision reflects the fundamental strengths and weaknesses of the Nigerian economy, offering valuable insights into the country’s economic prospects.

The ruling party, the All Progressives Congress (APC) spearheaded by President Bola Tinubu, has eagerly touted this news as a vindication of their governance policies. While it is undeniable that Nigeria possesses several economic strengths that contribute to its rating, the political climate and economic outlook still raise questions that require close scrutiny.

Nigeria’s Economic Strengths

Nigeria’s ‘B-‘ rating is underpinned by several key economic strengths, including its large and diversified economy, a well-developed domestic debt market, and substantial oil and gas reserves. These factors provide a solid foundation for the nation’s creditworthiness and economic stability.

Fitch Ratings presented a Stable Outlook that reflects both positive and negative dynamics at play in the Nigerian economy, making it essential for stakeholders to closely monitor developments in the coming years.

Persistent Challenges, APC’s Narrative and Fitch Ratings

The ruling party will argue that the Fitch Ratings reflects positively on the direction President Tinubu’s government has taken since coming to power in May 2023. Key achievements, such as the removal of fuel subsidies, unification of exchange rates, and ambitious revenue-raising plans, are presented as evidence of a government committed to economic reform and growth.

As the APC has seized upon Fitch Ratings‘ affirmation as an endorsement of their vision for Nigeria’s future, it is crucial to exercise caution amidst the jubilation surrounding this rating. Nigeria’s foreign exchange market, which has seen substantial movements recently, is a cause for concern. The rebounding value of the naira and a sudden influx of foreign capital into the market are indicative of an evolving situation. While these developments initially appear promising, their sustainability remains uncertain, and potential vulnerabilities in the foreign exchange market may pose.

Despite its economic strengths, Nigeria faces a series of significant challenges that constrain its rating. Weak governance, a heavy dependence on hydrocarbons, ongoing security concerns, high inflation, low foreign exchange (FX) reserves, and exchange-rate vulnerabilities are among the obstacles that continue to hamper the country’s economic progress.

Mixed Progress on Economic Reforms

The Nigerian government, under President Bola Tinubu, has made notable strides in implementing economic reforms. Key actions include the removal of fuel subsidies, unifying exchange rates, and initiating plans to increase revenue. However, there have been concerns about wavering commitment to these reforms, particularly in the foreign exchange market, where recent developments have raised questions about the government’s ability to sustain positive momentum.

Exchange Rate Challenges and Weakening FX Reserves

Nigeria continues to grapple with challenges in its foreign exchange market. FX shortages persist, hindering economic activity and deterring foreign capital. Efforts to close the gap between official and parallel exchange rates have encountered difficulties, with a premium of over 30% over the official rate. This discrepancy has been a source of concern, impacting daily FX turnover and overall market stability.

The Central Bank of Nigeria (CBN) has seen a decline in its gross FX reserves, falling to USD33.2 billion in September, down from USD37.1 billion at the end of 2022. Recent financial statements from the CBN have shed light on a weaker net foreign exchange position than previously understood, with significant undisclosed commitments. These factors add to the uncertainty in Nigeria’s foreign exchange landscape.

Charting Nigeria’s Economic Future: Caution Amidst Challenges

Nigeria stands at a critical juncture, where its economic strengths offer a solid foundation for growth and development, but the persistent challenges and uncertainties in the foreign exchange market, coupled with fiscal and macroeconomic issues, cast a shadow on the nation’s overall economic prospects. While the ruling All Progressives Congress (APC) celebrates Fitch Ratings’ affirmation, it is imperative to maintain a cautious outlook in light of the evolving economic landscape.

As the APC champions President Bola Tinubu’s government’s achievements, including the removal of fuel subsidies, exchange rate unification, and ambitious revenue-raising plans, it is crucial to consider the sustainability of these measures in the face of an ever-shifting foreign exchange market.

Nigeria’s ‘B-‘ rating is underpinned by its substantial economic strengths, such as its large and diversified economy, a well-established domestic debt market, and abundant oil and gas reserves. However, the challenges stemming from weak governance, dependence on hydrocarbons, security issues, high inflation, low foreign exchange reserves, and exchange-rate vulnerabilities continue to pose formidable obstacles.

The commitment of the Nigerian government to sustaining reforms and addressing these challenges will be pivotal in determining the country’s future credit rating and overall economic stability. Fitch’s Stable Outlook indicates a delicate balance between positive and negative dynamics in the Nigerian economy, underscoring the need for vigilant monitoring and a cautious approach in the years to come. As Nigeria navigates its economic path, stakeholders must remain watchful and adaptable to meet the challenges and seize the opportunities that lie ahead.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.