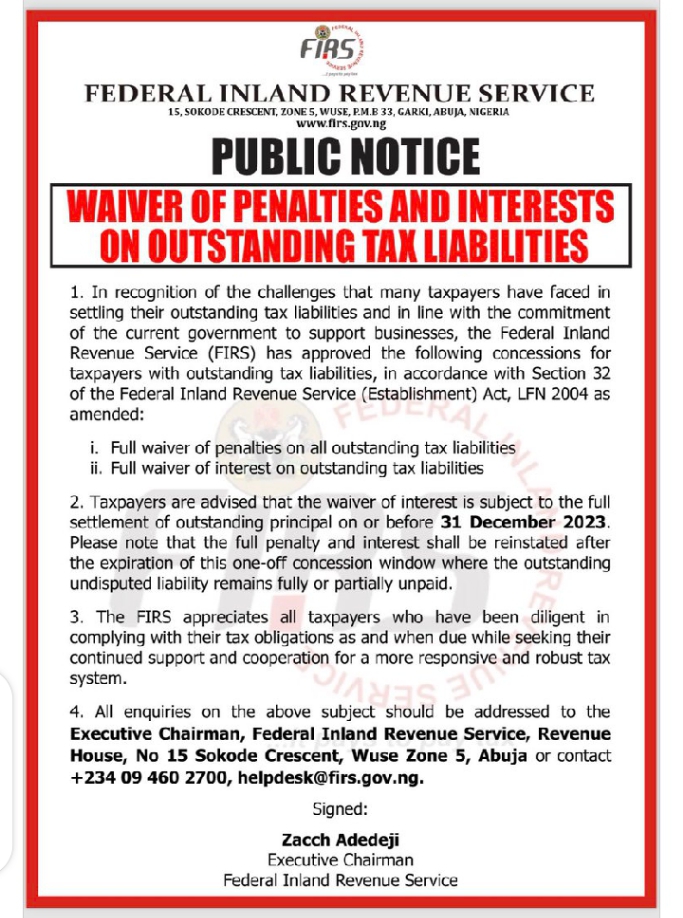

In a groundbreaking move, the Federal Inland Revenue Service (FIRS) has given the green light for concessions targeting taxpayers with lingering tax liabilities. This strategic initiative, sanctioned under Section 32 of the Federal Inland Revenue Service Act, aims to alleviate the financial burden on individuals and businesses grappling with outstanding tax obligations. The approval of these concessions reflects the government’s commitment to fostering economic recovery and providing relief to taxpayers facing financial challenges.

Under the new concessions, eligible taxpayers will enjoy a reprieve from penalties and interest accrued on their overdue tax payments. This proactive approach by FIRS underscores the recognition of the economic hardships faced by many taxpayers and seeks to create a more supportive environment for compliance.

Legal Framework – Section 32 of FIRS Act

The basis for these concessions lies in Section 32 of the Federal Inland Revenue Service Act. This section empowers the FIRS to exercise discretion in certain situations, allowing for the modification or waiver of penalties and interests. By leveraging this legal provision, FIRS aims to strike a balance between enforcing tax compliance and acknowledging the challenges faced by taxpayers, fostering a more collaborative and empathetic approach to revenue collection.

This move aligns with global trends where tax authorities are increasingly adopting flexible measures to encourage compliance rather than solely focusing on punitive actions. The application of Section 32 reflects a nuanced understanding of the economic landscape and a commitment to adaptability in tax administration.

Eligibility Criteria for Taxpayers

To benefit from these concessions, taxpayers must meet specific eligibility criteria outlined by the FIRS. Generally, these criteria may include timely application for the concessions, a commitment to settling the principal tax amount, and a demonstration of financial hardship. The FIRS has emphasized a case-by-case assessment, allowing for a personalized approach in evaluating each taxpayer’s circumstances. This flexibility ensures that deserving cases receive the relief they require while maintaining the overall integrity of the tax system.

By establishing clear eligibility criteria, FIRS aims to ensure that the concessions are directed towards those genuinely facing financial challenges, fostering transparency and fairness in the implementation of these measures.

Application Process and Timelines

Taxpayers seeking to avail themselves of these concessions must adhere to a defined application process. FIRS has streamlined the application procedure to make it accessible and efficient. This includes providing necessary documentation, explaining the reasons for seeking concessions, and detailing a feasible plan for settling the outstanding tax liabilities. Understanding the time sensitivity of many taxpayers’ situations, FIRS has also set specific timelines for the submission and processing of concession applications.

This structured approach ensures that the concessions process is both transparent and expedient, offering timely relief to eligible taxpayers while maintaining the overall effectiveness of the tax collection system.

Impact on Revenue Collection and Economic Stimulus

While critics may raise concerns about the potential impact on government revenue, FIRS anticipates that the long-term benefits of this concession strategy will outweigh short-term revenue adjustments. By fostering a more cooperative relationship with taxpayers, the concessions are expected to enhance overall compliance, reduce the burden of enforcement actions, and stimulate economic activity.

Moreover, the concessions align with broader economic recovery initiatives, recognizing the symbiotic relationship between taxpayer well-being and a thriving economy. As businesses and individuals find relief from excessive financial strain, the potential for increased economic activities and investments becomes more viable, contributing to a positive cycle of growth.

Future Outlook and Public Reception

Looking ahead, the FIRS envisions an improved tax compliance landscape as a result of these concessions. The public reception to this move is expected to be positive, reflecting the government’s responsiveness to the challenges faced by taxpayers. By demonstrating a commitment to flexibility and understanding, FIRS aims to build trust within the taxpayer community, paving the way for more collaborative efforts in the future.

The approval of concessions by FIRS represents a significant step towards a more balanced and empathetic tax administration. As the implementation unfolds, the impact on individual taxpayers, businesses, and the overall economy will be closely monitored, providing valuable insights into the effectiveness of this forward-thinking approach to tax collection.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.