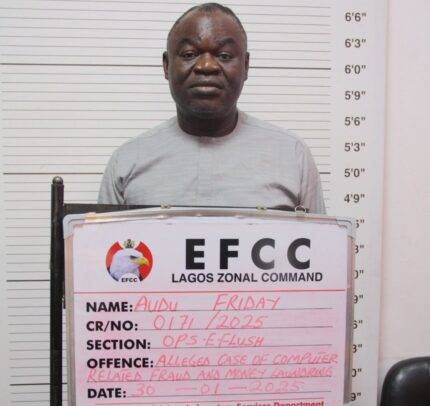

The Lagos Zonal Directorate of the Economic and Financial Crimes Commission (EFCC) on Monday, March 17, 2025, arraigned three individuals – two Chinese nationals, Huang Haoyu and An Hongxu, alongside a Nigerian, Audu Friday – before Justice Daniel Osiagor of the Federal High Court in Ikoyi, Lagos. The defendants are facing an 11-count charge related to cyber-terrorism, computer-related offences, and money laundering. The alleged amounts in question include a staggering N3,407,824,740.78 (approximately Three Billion, Four Hundred and Seven Million Naira) and $2,562,203 (about Two Million, Five Hundred and Sixty-Two Thousand US Dollars).

The Allegations: Cyber-Terrorism and Money Laundering

The charges against the defendants stem from their alleged involvement in a sophisticated cybercrime syndicate, which has raised serious concerns about the economic and social stability of Nigeria. According to the EFCC, the defendants, alongside others, were part of a criminal network that engaged in fraudulent cryptocurrency investments and romance fraud schemes. The prosecution asserts that the defendants conspired to use Nigerian youths to impersonate foreign nationals, aiming to destabilize the country’s economy through a series of deceptive online activities.

One of the key charges includes their alleged use of computer systems to manipulate financial markets for personal gain, violating the Cybercrimes (Prohibition, Prevention, Etc.) Act of 2015, as amended in 2024. This act specifically prohibits any activities aimed at destabilizing national economies via cybercrimes, such as the ones allegedly committed by the accused. The EFCC maintains that the defendants’ actions were not only aimed at financial gain but also intended to disrupt the country’s social fabric by manipulating public trust in online platforms.

The Operation: Eagle Flush by EFCC

The arrest of the three defendants followed a surprise operation dubbed “Eagle Flush,” which was executed by EFCC operatives on December 19, 2024, in Lagos. The operation resulted in the capture of 792 individuals who were allegedly involved in various online fraud activities, including those associated with cryptocurrency scams and romance fraud. The operation’s success highlighted the increasing sophistication of cybercriminals targeting Nigerian citizens and international investors through false online representations.

The EFCC’s investigation into the syndicate revealed that Friday, the Nigerian defendant, had incorporated the company Genting International Co. Ltd. under the directive of Huang Haoyu. This company was reportedly used as a front for the illicit activities, which included the laundering of vast sums of money through cryptocurrency transactions and fraudulent online investments. The EFCC alleges that the funds were funneled through the company’s account in Union Bank, where they were retained despite clear evidence that they were proceeds of unlawful activity.

The Financial Dimensions of the Fraud

At the heart of the charges is the alleged retention of over N3.4 billion and more than $2.5 million, funds that were purportedly laundered through the Genting International Co. Ltd. account. The EFCC claims that these funds were part of a larger money-laundering operation that sought to legitimize money obtained from fraudulent activities, including cyber-terrorism and cryptocurrency scams. The suspects are accused of using the funds to gain financial advantage and further their criminal enterprises. According to the EFCC, the vast sums were transferred across borders, with the intention of disguising the origins of the money to evade detection by authorities.

The scale of the fraud highlights the significant global reach of cybercrime syndicates, which often exploit weaknesses in financial systems to launder illicit proceeds. The EFCC’s efforts to track and seize these funds represent a crucial step in combating the growing threat of financial crimes that exploit emerging technologies.

The Court Hearing: Pleas and Bail Application

The accused individuals pleaded not guilty to the charges when they were read in court, and the prosecution, led by Bilkisu Buhari, requested a prompt trial date. Buhari also asked that the defendants be remanded in EFCC custody while awaiting trial. Counsel for the first defendant, Emeka Okonkwo, SAN, argued for the remand of the accused in EFCC custody pending the hearing of a bail application.

Justice Osiagor, after hearing the submissions, ordered that the defendants be remanded in the custody of the EFCC. The matter was adjourned for the hearing of the bail application, with the court set to deliberate on whether the accused should be granted bail or remain in custody pending the trial’s continuation. The EFCC’s ongoing efforts to prosecute cybercriminals and prevent money laundering represent a critical aspect of Nigeria’s broader strategy to combat financial crimes and maintain national economic security.

Implications for National Security and Cybercrime Prevention

This high-profile case underscores the growing threat of cybercrime in Nigeria, which has become a significant concern for law enforcement agencies, financial institutions, and the general public. The EFCC’s role in investigating and prosecuting cybercriminals is crucial, not only in terms of curbing the financial losses caused by such crimes but also in maintaining national security. The scale and complexity of the alleged cyber-terrorism activities highlight the need for robust legal frameworks and increased international cooperation in tackling financial crimes that transcend borders.

As the trial progresses, attention will remain focused on the broader implications for cybercrime prevention in Nigeria, particularly as the nation continues to confront the evolving challenges of online fraud and money laundering.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.