The Port Harcourt Zonal Command of the Economic and Financial Crimes Commission (EFCC) has brought charges against Mr. Kanu Ifesinachi Tenison and his company, Vikan Integrated Services Nigeria Limited. They are facing an 11-count indictment before Justice P. M. Ayua of the Federal High Court in Port Harcourt, Rivers State. The charges include criminal breach of trust, forgery, alteration, and obtaining money under false pretenses.

One charge states that between September 18 and September 30, 2023, Tenison and his company fraudulently obtained ₦10,200,000 from Mr. Robinson Adakosa under the pretense of securing a lucrative investment contract with Nigeria Liquefied Natural Gas (NLNG). Another charge alleges that between August 15 and December 1, 2023, they defrauded Mr. Tekena Erekeosima of ₦22,000,000 with similar false promises of high returns from an NLNG contract. Both charges highlight the defendants’ violation of the Advance Fee Fraud and Other Related Offences Act, 2006.

Court Proceedings and Defendant’s Plea

During the court proceedings, Mr. Tenison pleaded not guilty to all charges. The prosecution, led by counsel K. U. Odus, requested a trial commencement date and the remand of Tenison in prison custody. Conversely, the defense counsel, G. Christopher, appealed for bail, arguing that the defendant needed to prepare adequately for the trial.

Justice Ayua, in her ruling, ordered that Tenison be remanded in the custody of the Nigeria Correctional Service in Port Harcourt. She adjourned the case to June 20, 2024, for the hearing of the bail application. This decision marks the beginning of what could be a lengthy legal battle for Tenison and his company as they confront serious fraud allegations.

Background and Allegations

The trouble for Tenison and Vikan Integrated Services Nigeria Limited began in December 2023 when a petitioner accused Tenison of soliciting $11,700 to secure a contract with NLNG for the company. The petitioner claimed that an agreement was reached whereby Tenison would repay ₦3,750,000 upon the execution of the contract and payment by NLNG. However, Tenison allegedly failed to honor the agreement, leading the petitioner to seek redress through the EFCC.

This case underscores the ongoing challenges in combating financial fraud in Nigeria. The EFCC’s efforts in bringing such cases to court aim to uphold the rule of law and protect investors from fraudulent schemes. The upcoming trial will be closely watched as it may set a precedent for similar cases in the future.

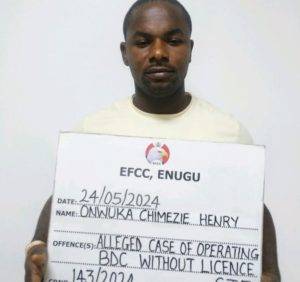

Also EFCC Arraigns Fake BDC Operators in Enugu for Currency Racketeering

On Friday, May 24, 2024, the Enugu Zonal Command of the Economic and Financial Crimes Commission (EFCC) brought Onwuka Chimezie Henry and Ekene Ibegbu before Justice F. O. Giwa-Ogunbanjo of the Federal High Court, Enugu. The duo faced a two-count charge related to currency racketeering and operating an unauthorized bureau de change (BDC) business. The charges specified that they conducted BDC operations under the name “Archibenkong Enterprises Bureau De Change” without proper licensing and incorporation, violating the Banks and Other Financial Institutions Act No. 5, 2020.

The court documents detailed their actions, noting that Henry and Ibegbu were engaged in unlicensed financial operations in February 2024 along Owerri Road, Enugu. They both pleaded not guilty when arraigned, prompting the EFCC’s counsel, Nasir Umar, to request a trial date and the defendants’ remand at the Enugu State Correctional facility. Meanwhile, defense lawyers E. C. Nnaedozie and J. A. Okuta filed for bail, which was strongly opposed by the EFCC due to concerns over the increasing prevalence of such crimes and the risk of the defendants absconding.

Court Grants Bail Under Strict Conditions

Despite the EFCC’s objections, Justice Giwa-Ogunbanjo granted bail to the accused. Each defendant was required to post N1,000,000 (One Million Naira) with two sureties in like sum. These sureties had to possess substantial property within Enugu and provide proof of tax payments. Additionally, the EFCC was tasked with verifying the sureties’ addresses within seven days to ensure compliance with the bail conditions. Following this, the defendants were remanded in custody pending these verifications, with the trial date set for October 16, 2024.

The second defendant, Ibegbu, was apprehended by the EFCC’s Joint Task Force on February 8, 2024, following intelligence reports about his involvement in illegal currency trading. Investigations revealed that Ibegbu operated under Henry’s instructions, who ran the BDC without the necessary legal backing. Henry was subsequently detained on February 13, 2024, further unraveling the extent of their unlawful financial operations. This case underscores the EFCC’s ongoing efforts to clamp down on illegal financial activities and enforce compliance with financial regulations in Nigeria.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.