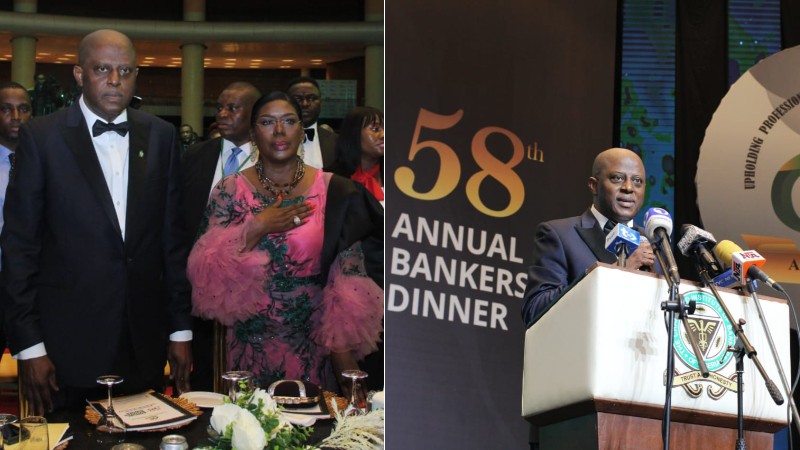

The Central Bank of Nigeria (CBN) set the tone for a significant shift in the country’s banking landscape, proposing a substantial increase in the capital base of Deposit Money Banks (DMBs). Governor Dr. Olayemi Cardoso articulated this at the 58th Annual Dinner of the Chartered Institute of Bankers of Nigeria. The move aims to align the banking sector with President Bola Tinubu’s vision of a robust $1 trillion economy in the next seven years. Cardoso emphasized the imperative of evaluating banking industry adequacy in servicing this ambitious economic milestone.

Industry Response and Actions of Banks Amid Economic Realities

In response to CBN’s directive, top executives of various banks are actively strategizing to fortify their institutions’ capital base. Preliminary talks on mergers, acquisitions, and capital infusion have already commenced, showcasing a proactive approach by these financial entities. Several banks, including First Bank of Nigeria Holdings, Wema Bank, Jaiz Bank, and Fidelity Bank, have announced plans for Rights Issues, additional capital raising, and proposed share issuances.

While the industry welcomes the policy direction set by the CBN, concerns loom regarding the economic challenges faced in raising substantial capital. Some bank officials highlighted potential hurdles in meeting the increased capital demand given the prevailing economic conditions. Discussions regarding mergers and alliances among weaker and middle-strength banks underscore the collaborative stance in navigating these challenges.

Top bank executives indicated an escalation in merger discussions, considering these as potential strategies to navigate the impending capital requirements. There’s speculation that banks might lean more towards engaging institutional investors rather than public listings due to the current economic climate in Nigeria. Rasheed Bolarinwa, President of the Association of Corporate and Marketing Communications Professionals in Banks, advised the public to await formal guidelines before drawing conclusions about the potential impact on the industry.

Prospects and Regulatory Clarity

The industry remains optimistic about investor receptivity, especially in bank stocks, anticipating favorable responses during the recapitalization process. However, uncertainties persist regarding the potential industry contraction and the precise impact on various banks’ performance. Bolarinwa emphasized the regulator’s adeptness in managing Nigeria’s banking sector and urged patience for the official unveiling of the recapitalization plan.

The proposal by the Central Bank of Nigeria (CBN) to bolster banks’ capital base has ignited divergent opinions among financial experts. Dr. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise, welcomed the move, highlighting the dire need for an increased capital base due to the drastic depreciation of the domestic currency. He emphasized that the current capital requirements were insufficient and urged a reevaluation in light of the economic shift since the 2004 banking consolidation.

Uche Uwaleke, a Capital Market professor, expressed support for the idea but cautioned against coercion. He stressed the necessity for incentivizing banks rather than adopting forceful measures, citing the need for a more nuanced approach compared to the previous recapitalization drive.

CBN’s Strategic Approaches and Concerns

Experts like Prof. Akpan Ekpo echoed concerns about potential mergers and acquisitions resulting from enforced recapitalisation, warning of its adverse effects on employment rates and economic stability. Emphasizing the importance of incentivizing banks, Ekpo urged against undue pressure that might trigger uncertainties within the financial sector.

On the positive side, economist Leo Ukpong outlined the advantages of bank recapitalisation, underscoring its potential to fuel economic growth. He highlighted that raising additional capital could enable increased lending to various sectors, fostering infrastructural development and risk diversification.

Critiques and Alternative Focus

However, some economists criticized the CBN’s focus on recapitalisation. Marcel Okeke, a former Chief Economist at Zenith Bank Plc, suggested introspection before enforcing such policies, pinpointing existing governmental policies impacting the economy negatively. He emphasized that a recapitalisation drive must be considered in light of the larger economic policies to prevent unintended consequences.

Professor Abayomi Adebayo faulted the emphasis on recapitalisation, suggesting a more robust focus on tackling foreign exchange market challenges and fostering productivity within the economy. He urged for a shift towards developing entrepreneurship and actively financing sectors to address critical issues like fuel scarcity.

Recapitalization Strategy in Response to Global Economic Challenges

Central Bank of Nigeria (CBN) may have introduced a Recapitalization Plan to fortify Nigeria’s financial resilience amid the prevailing global economic downturn as highlighted by the apex bank governor in his recent speech. This strategic initiative comes in the wake of escalating tensions between Israel and Hamas, exacerbating the challenges faced by the international community in achieving economic recovery.

During a notable address at the bankers’ summit, the CBN governor highlighted the multifaceted factors contributing to global economic woes. Notably, the ongoing conflict has been underscored by the International Monetary Fund (IMF), which has issued warnings about the far-reaching implications of such crises on global economic performance. The IMF contends that these geopolitical conflicts limit the margin for policy errors and present a substantial threat to worldwide economic stability.

The governor’s speech elucidated the interconnectedness of these challenges, emphasizing the inflationary pressures stemming from the Russia-Ukraine conflict. The surge in energy prices, a direct consequence of this geopolitical standoff, has prompted monetary authorities worldwide to respond by raising policy interest rates. This global response has, in turn, led to tightened conditions in financial markets globally, triggering significant capital outflows from emerging market countries.

In navigating this intricate landscape, the CBN’s Recapitalization Plan emerges as a pivotal strategy. It reflects a proactive approach aimed at bolstering Nigeria’s financial sector against the headwinds of global economic uncertainties. As nations grapple with the complex repercussions of geopolitical crises, the CBN’s initiative underscores the imperative for adaptive and forward-looking measures to sustain economic stability in Nigeria.

Challenges and Calls for Clarity

The reactions to the CBN’s proposal paint a varied landscape of opinions. While some stress the importance of recapitalisation for economic growth, others caution against the potential pitfalls of enforced measures without holistic economic reforms. The need for clarity, comprehensive plans, and a balanced approach to incentivize rather than coerce banks remains a central point in the ongoing discourse.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.