Ensuring Forex Market Stability: CBN’s Decisive Move Against Defaulters

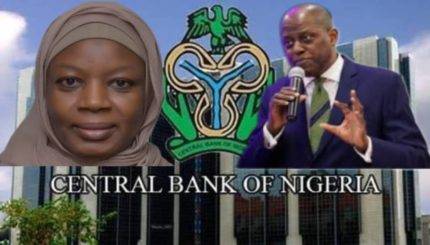

The Central Bank of Nigeria (CBN) is taking a bold step to address mounting concerns within the financial landscape by announcing its intention to prosecute forex defaulters. This strategic move is prompted by the escalating worries tied to the approximately $7 billion in matured forex forwards, a situation that has stirred anxiety among investors. Mrs. Sidi Ali, the Acting Director of Communication at the CBN, emphasized the commitment to instill confidence in the foreign exchange markets.

The CBN aims to achieve this by enforcing legal actions against those responsible for the delay in payments, highlighting the imperative need for timely settlement of these maturing forwards. This proactive stance by the CBN is poised to strengthen the forex market’s stability and foster a more secure environment for investors.

With the announcement of its intent to prosecute forex defaulters, the Central Bank of Nigeria (CBN) is signaling a clear commitment to safeguarding investor confidence and ensuring market integrity. The urgency stems from the looming challenge of managing nearly $7 billion in matured forex forwards, which has raised apprehensions among market participants. Mrs. Sidi Ali, Acting Director of Communication at the CBN, underscores the significance of this decisive action in boosting trust in the foreign exchange markets. By actively pursuing legal measures against defaulters, the CBN aims to create an environment where timely payments for maturing forwards become a norm, thereby contributing to the overall stability and resilience of the Nigerian financial landscape.

CBN’s Assurance and Payment Commitment

In response to growing investor concerns, the Central Bank of Nigeria (CBN) has unequivocally pledged to meet its financial commitments, particularly in the timely payment of matured forex forwards. Mrs. Sidi Ali, a notable representative, underscored the central bank’s unwavering commitment to resolving the legitimate foreign exchange backlog, a commendable and sustained initiative spanning the last three months. This proactive approach reflects the CBN’s dedication to fostering stability within Nigeria’s foreign exchange landscape, aiming to instill confidence among market participants and alleviate apprehensions in the investor community.

The CBN’s assurance to settle matured forex forwards is not merely a short-term commitment but represents a consistent and strategic effort over the past quarter. By prioritizing the resolution of foreign exchange concerns, the central bank aims to create a favorable environment for market participants. This sustained dedication is poised to have a positive impact on Nigeria’s financial stability, with the potential to bolster investor confidence and contribute to the overall health of the country’s economic landscape, ultimately positioning it favorably for sustained growth.

Independent Forensic Review Unveils Forex Exchange Issues

In response to the intricate challenges tied to forex exchange within Nigeria, the Central Bank of Nigeria (CBN) has taken a proactive step by initiating an impartial forensic review conducted by a well-established firm. As disclosed by Mrs. Sidi Ali, the findings of this comprehensive review have brought to light severe infractions, widespread abuse, and substantial non-compliance with market regulations. This revelation marks a critical juncture in the CBN’s approach, signaling its dedication to maintaining a fair and regulated forex market. The CBN’s commitment is further underscored by its intention to collaborate with relevant agencies in enforcing appropriate sanctions, emphasizing a robust stance against malpractices to safeguard the integrity of the forex landscape.

By commissioning this independent forensic review, the CBN showcases its transparency and commitment to addressing issues head-on, instilling confidence in stakeholders and market participants. The forthcoming collaboration with pertinent agencies to implement corrective measures not only highlights the gravity of the identified infractions but also positions the CBN as a vigilant regulator keen on upholding the integrity of the forex market in Nigeria. This strategic move is poised to resonate positively within the financial sector and contribute to the establishment of a more compliant and transparent environment, ultimately enhancing the overall stability and fairness of the forex exchange landscape in the country.

Grave Infractions and Non-Compliance Unveiled

In a comprehensive independent forensic review, severe infractions and notable non-compliance with market regulations within Nigeria’s forex exchange have been brought to light. Mrs. Sidi Ali, a prominent figure in the financial sector, unequivocally asserts that the Central Bank of Nigeria (CBN) is poised to take resolute action. Collaborating with pertinent agencies, the CBN plans to enforce stringent sanctions to address the identified issues. This assertive stance reflects a robust commitment to upholding the integrity and stability of the foreign exchange markets in Nigeria.

The proactive measures undertaken by the CBN underscore a dedication to rectifying the detected irregularities, sending a clear message to market participants about the seriousness with which regulatory adherence is viewed. The collaborative enforcement approach with relevant agencies amplifies the impact of the corrective actions, signaling a united front in safeguarding the integrity of Nigeria’s forex market. This commitment is likely to resonate positively in regulatory circles and among investors, fostering an environment of trust and compliance within the foreign exchange sector.

Nigeria’s Forex Market Challenges and Oil Production Impact

In Nigeria, the persistent foreign currency shortages have reached a critical juncture, primarily intensified by a substantial decline in oil production. The nation heavily relies on oil, contributing to over 90% of its dollar inflows. As oil production dwindles, a ripple effect is witnessed in the foreign exchange market, leading to a diminished availability of foreign currency. This adverse impact underscores the urgency of implementing comprehensive measures to tackle the root causes, aiming to restore confidence in Nigeria’s foreign exchange markets. Swift and strategic interventions are imperative to mitigate the challenges posed by the reduced availability of foreign exchange, ensuring stability and resilience in the country’s economic landscape.

The ongoing challenges in Nigeria’s forex market necessitate a holistic approach to address the multifaceted issues triggered by the decline in oil production. As the nation grapples with reduced dollar inflows, policymakers must prioritize implementing measures that go beyond short-term fixes. A comprehensive strategy is crucial, encompassing initiatives to diversify the economy, boost non-oil sectors, and enhance the overall resilience of the foreign exchange market. By addressing the root causes and fostering a conducive environment for economic growth, Nigeria can pave the way for a sustainable solution to its foreign currency shortages, instilling confidence among investors and stakeholders in the process.

CBN’s Ongoing Efforts to Address Forex Challenges

In the dynamic landscape of Nigeria’s forex market, the Central Bank of Nigeria (CBN) emerges as a resilient force, steadfast in its commitment to tackle prevailing challenges. Despite the complexities, Mrs. Sidi Ali, a representative of the CBN, asserts that the central bank remains unwavering in its determination to address pertinent issues. Notably, the institution’s emphasis on settling the legitimate foreign exchange backlog has been consistent over the last three months, marking a sustained effort to alleviate concerns and streamline the forex processes. This proactive approach underscores the CBN’s dedication to overcoming obstacles, promoting stability, and cultivating confidence within Nigeria’s foreign exchange sphere.

Mrs. Sidi Ali’s recent statement reinforces the CBN’s ongoing commitment to fostering positive change in the forex market. The central bank’s resilience in addressing challenges and its dedicated efforts to clear foreign exchange backlogs demonstrate a strategic and consistent approach. By prioritizing the resolution of legitimate concerns and showcasing a sustained commitment over the past three months, the CBN not only navigates the complexities of the forex market but also establishes a foundation for stability. This, in turn, contributes to instilling confidence among stakeholders and participants, reinforcing the central bank’s pivotal role in shaping the nation’s foreign exchange landscape.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.