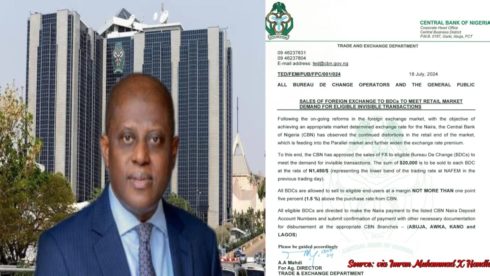

The Central Bank of Nigeria (CBN) has given the green light for the sale of $20,000 to every Bureau de Change (BDC) in the country. This move is aimed at increasing foreign exchange liquidity in the market and reducing the pressure on the naira. The CBN has fixed the exchange rate at N1,450 per US dollar, which is expected to stabilize the market and boost investor confidence.

The sale of $20,000 to BDCs is a significant step towards achieving exchange rate stability and promoting economic growth. With this move, the CBN is demonstrating its commitment to providing a stable and transparent foreign exchange market. The approved rate of N1,450 per US dollar is expected to reduce the gap between the official and parallel market rates, thereby discouraging illegal foreign exchange trading.

BDCs Can Sell to Qualified End-Users

All authorized BDCs in Nigeria are now permitted to sell foreign exchange to qualified end-users. The Central Bank of Nigeria has set a margin of not more than one and a half percent (1.5%) above the buying rate from the CBN. This means that BDCs can sell foreign exchange to end-users at a rate not exceeding N1,475 per US dollar. The CBN’s move is expected to increase access to foreign exchange and reduce the cost of doing business in Nigeria.

The sale of foreign exchange to qualified end-users is subject to certain conditions. End-users must provide valid identification and proof of business ownership. They must also demonstrate a genuine need for foreign exchange for eligible transactions such as importation of goods and services, travel, and education. The CBN’s guidelines are aimed at ensuring that foreign exchange is sold to genuine end-users and not diverted for illegal activities.

CBN Moves to Stabilize Exchange Rate

The Central Bank of Nigeria has taken a significant step towards stabilizing the exchange rate. By approving the sale of $20,000 to every BDC, the Central Bank of Nigeria is increasing foreign exchange liquidity in the market. This move is expected to reduce the pressure on the naira and stabilize the exchange rate. The CBN’s decision is a testament to its commitment to promoting economic stability and growth.

The Central Bank of Nigeria’s move is also expected to boost investor confidence in the Nigerian economy. With a stable exchange rate, investors can better predict their returns on investment, thereby increasing their willingness to invest in the country. The Central Bank of Nigeria’s guidelines are aimed at promoting a stable and transparent foreign exchange market, which is essential for economic growth and development.

Foreign Exchange Market to Receive Boost

The foreign exchange market in Nigeria is expected to receive a significant boost following the Central Bank of Nigeria’s approval of the sale of $20,000 to every BDC. The increased liquidity in the market is expected to reduce the gap between the official and parallel market rates. This move is also expected to increase access to foreign exchange and reduce the cost of doing business in Nigeria.

The Central Bank of Nigeria’s move is a welcome development for businesses and individuals who rely on foreign exchange for their operations. With increased access to foreign exchange, businesses can import goods and services, pay for tuition and travel expenses, and engage in other eligible transactions. The CBN’s guidelines are aimed at promoting a stable and transparent foreign exchange market, which is essential for economic growth and development.

BDCs to Operate Within CBN Guidelines

All authorized BDCs in Nigeria are expected to operate within the guidelines set by the CBN. The Central Bank of Nigeria has set a margin of not more than one and a half percent (1.5%) above the buying rate from the CBN. BDCs are also expected to sell foreign exchange to qualified end-users at a rate not exceeding N1,475 per US dollar. The Central Bank of Nigeria’s guidelines are aimed at ensuring that foreign exchange is sold to genuine end-users and not diverted for illegal activities.

The Central Bank of Nigeria’s guidelines are also expected to increase transparency in the foreign exchange market. BDCs are expected to maintain accurate records of their transactions and report any suspicious activities to the Central Bank of Nigeria. The CBN’s move is a significant step towards promoting a stable and transparent foreign exchange market, which is essential for economic growth and development.

Economic Growth Expected to Receive Boost

The Nigerian economy is expected to receive a significant boost following the Central Bank of Nigeria’s approval of the sale of $20,000 to every BDC. The increased liquidity in the foreign exchange market is expected to reduce the pressure on the naira and stabilize the exchange rate. This move is also expected to increase access to foreign exchange and reduce the cost of doing business in Nigeria.

The Central Bank of Nigeria’s move is a welcome development for the Nigerian economy. With a stable exchange rate, businesses can better predict their returns on investment, thereby increasing their willingness to invest in the country. The CBN’s guidelines are aimed at promoting a stable and transparent foreign exchange market, which is essential for

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.