The National Assembly joint committee on Appropriations has raised concerns over the impact of tax waivers on the nation’s revenue. The committee, led by Senator Adeola Olamilekan, emphasized the need for the federal government to discontinue the practice of granting tax concessions to corporate entities. According to the committee, the country is experiencing significant revenue loss due to these concessions.

The committee proposed a revised approach where companies pay their taxes in full to the government before requesting any rebate. This recommendation aims to ensure that the government receives its due revenue and minimizes the potential misuse of tax incentives by corporations. During an interactive session on the 2024 budget, members of the committee expressed the urgency of addressing this issue to safeguard the country’s financial stability.

Minister Advocates for Islamic Financial Market in Infrastructure Funding

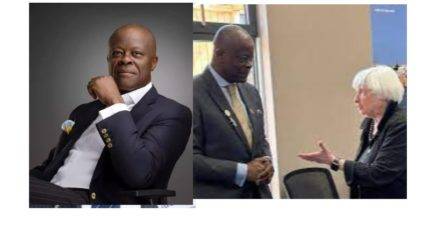

In a related development, the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, highlighted the potential of the non-interest financial market, also known as the Islamic financial market, as a viable source for funding major infrastructure projects. Edun suggested that embracing this alternative financial model could offer a cheaper and more sustainable means of raising funds.

The minister’s statement implies a shift in perspective regarding funding mechanisms, indicating a willingness to explore global non-interest markets. This strategic move aligns with the ongoing efforts to diversify funding sources for critical infrastructure projects. The acknowledgment of the non-interest financial market as a viable option underscores the government’s commitment to exploring innovative approaches for economic development.

Massive Revenue Loss to Tax Waivers Revealed

During the interactive session on the 2024 budget, Finance Minister Wale Edun disclosed a staggering loss of over N3 trillion to tax waivers in the current year. This revelation by the minister further fueled concerns within the National Assembly joint committee on Appropriations about the negative impact of these concessions on the nation’s finances.

Senator Mohammed Sani Musa proposed adopting a system of withholding taxes for companies benefitting from tax waivers. This alternative approach aims to create a fund where companies prove tax compliance before receiving rebates. The committee members emphasized the urgency of addressing these revenue leakages and called for bold decisions to curtail the misuse of tax credits and waivers.

Call for Withholding Taxes System to Curb Revenue Loss

Senator Mohammed Sani Musa (APC, Niger) advocated for the adoption of a withholding taxes system to regulate tax waivers effectively. Drawing parallels with the current withholding taxes practice, he proposed creating a fund where companies prove tax compliance before receiving rebates. This system aims to ensure accountability and transparency in the utilization of tax incentives, preventing misuse and revenue loss.

The suggestion aligns with the committee’s broader goal of plugging revenue leakages and strengthening the fiscal responsibility of corporate entities. As discussions on the 2024 budget continue, the proposal for a withholding taxes system reflects a pragmatic approach to addressing the challenges associated with tax waivers.

Bold Decision Needed: Comparisons to Fuel Subsidy Removal

Senator Ali Ndume (APC, Borno) emphasized the need for bold decisions similar to the government’s stance on fuel subsidy removal. Drawing parallels, he commended the President’s bold move to eliminate fuel subsidies, highlighting the positive impact on the nation’s fiscal health. Ndume urged the Minister of Finance to take a similar decisive step in discontinuing tax credits and waivers, asserting that such actions should be appropriately appropriated through the National Assembly.

The senator’s call for bold decisions underscores the urgency felt within the National Assembly to address what he perceives as unnecessary advantages taken by some entities at the expense of the Nigerian people. The comparison to fuel subsidy removal serves as a reminder of the government’s capacity for impactful economic decisions.

Loopholes in Revenue Collection Threaten National Finances

Senator Ali Ndume (APC, Borno) pointed out the critical issue of revenue collection loopholes negatively impacting the country. He emphasized the exploitation of these loopholes by a few individuals, draining the nation’s resources. Ndume urged immediate action to eliminate these illegalities and stressed the importance of adhering to constitutional procedures for revenue-related matters.

The senator’s concern highlights the broader challenge of ensuring a robust and transparent revenue collection system. Addressing these loopholes becomes paramount to safeguarding the nation’s financial stability and preventing exploitation by a select few. The call for adherence to constitutional processes reflects a commitment to upholding legal frameworks for sound fiscal management.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.