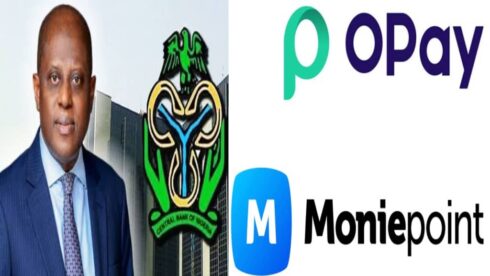

The Central Bank of Nigeria (CBN) has imposed hefty fines of ₦1 billion each on Moniepoint and OPay, two of Nigeria’s leading fintech companies. The fines come after a routine compliance audit revealed significant lapses in adhering to regulatory guidelines. This action underscores the CBN’s commitment to enforcing strict compliance measures within the fast-growing fintech sector.

According to a statement by the CBN, the penalties were levied to address violations of anti-money laundering (AML) and know-your-customer (KYC) protocols. These breaches are critical to Nigeria’s financial ecosystem as the country continues to tackle issues like fraud, illicit financial flows, and terrorism financing. The central bank aims to reinforce trust and integrity within the system by ensuring all players strictly adhere to regulatory requirements.

Moniepoint and OPay Face Backlash Amid Rising Regulatory Scrutiny

Moniepoint and OPay, both major players in Nigeria’s digital financial services space, have been at the forefront of driving financial inclusion. However, the recent fines cast a shadow over their operations. The CBN’s audit found that both companies failed to implement adequate safeguards, particularly in monitoring high-risk transactions and maintaining accurate customer records.

Industry experts believe these developments could affect the reputations of the two companies, especially in a highly competitive fintech landscape. Despite their contributions to Nigeria’s economy, the infractions have raised concerns about governance structures and operational transparency. The fines also serve as a cautionary tale for other fintech operators in the country.

Implications for Nigeria’s Booming Fintech Industry

The penalties highlight the challenges of balancing innovation with regulation in Nigeria’s fintech ecosystem, which has experienced exponential growth in recent years. As new players continue to emerge, the CBN has stepped up efforts to enforce compliance to ensure the sector remains sustainable and secure.

Observers argue that the fines could signal a shift toward stricter enforcement, potentially leading to higher compliance costs for fintech firms. While some stakeholders view this as a necessary step to enhance credibility, others worry it could stifle innovation and deter foreign investment in the sector.

CBN’s Broader Strategy to Strengthen Financial Regulations

The fines align with the CBN’s broader strategy to tighten financial regulations and curb systemic risks in Nigeria’s economy. This includes an increased focus on digital platforms, which have seen rising adoption rates among Nigerians. The central bank has reiterated its resolve to maintain oversight and ensure fintech companies operate within the ambit of the law.

Additionally, the CBN is working to enhance its technological capabilities to monitor and regulate digital transactions more effectively. Experts note that this move could deter future infractions and foster a more transparent and secure financial environment in Nigeria.

Moniepoint and OPay Respond to Regulatory Sanctions

Both Moniepoint and OPay have issued statements acknowledging the fines and pledging to rectify the identified shortcomings. Moniepoint, in its response, emphasized its commitment to improving its compliance framework and aligning with regulatory expectations. Similarly, OPay expressed its willingness to collaborate with the CBN to address the flagged issues.

While the companies have shown willingness to comply, the development poses financial and operational challenges, particularly as they work to regain public trust. Industry watchers will closely monitor how both companies navigate this regulatory hurdle in the coming months.

The Road Ahead for Nigerian Fintechs

As Nigeria continues to solidify its position as a fintech hub in Africa, regulatory compliance has become more critical than ever. The recent fines signal that the era of leniency is over, and companies must prioritize compliance to thrive in the sector.

For Moniepoint, OPay, and other fintech players, the focus must now shift to building robust internal systems that meet regulatory requirements. Strengthening governance structures and fostering a culture of compliance will be essential for ensuring sustainable growth in Nigeria’s evolving financial landscape.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.