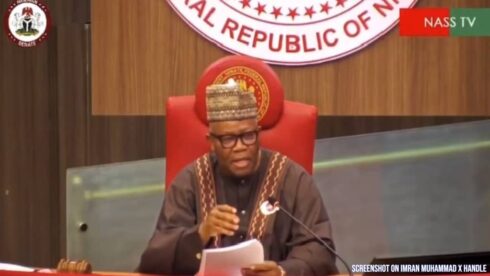

Senate President Godswill Akpabio has reiterated the commitment of the Nigerian Senate to maintain transparency and accountability in the ongoing tax reform processes. Speaking at a recent session, Godswill Akpabio urged stakeholders, including governors, religious leaders, and business magnates, to channel their concerns and recommendations through public hearings rather than exerting undue influence on the legislative body.

Godswill Akpabio emphasized that the Senate will not succumb to external pressures or intimidation, stating, “If there is any governor or any stakeholder in Nigeria… you know where to go to: the public hearing. The Senate will not be bullied.” This bold stance underscores the legislature’s resolve to prioritize national interest over sectional demands in the tax reform discourse.

Tax Reform Bills: Key Features and Implications

The proposed tax reform bills aim to streamline Nigeria’s revenue generation system, improve compliance, and close existing loopholes in tax collection. These reforms are expected to introduce changes in taxation policies, expand the tax base, and address fiscal inefficiencies that have plagued the nation for decades.

Experts believe that these reforms could significantly boost Nigeria’s non-oil revenue, providing much-needed fiscal stability. However, the potential increase in tax liabilities for individuals and businesses has sparked debates, with critics raising concerns over timing and implementation strategies amid prevailing economic hardships.

Stakeholders’ Reactions: Mixed Opinions Emerge

The tax reform bills have elicited mixed reactions across Nigeria’s socio-economic and political landscape. While some stakeholders commend the move as a bold step toward fiscal sustainability, others view it as an additional burden on citizens and businesses already grappling with inflation and economic downturns.

Governors and religious leaders have reportedly voiced apprehensions about the implications of the reforms on state allocations and charitable activities, respectively. Business groups have also called for more engagement and clarity on how the reforms would affect their operations.

Public Hearings: A Platform for Constructive Dialogue

Godswill Akpabio’s insistence on public hearings highlights the Senate’s commitment to an inclusive legislative process. Public hearings provide a platform for stakeholders to present data-driven arguments, propose amendments, and ensure that the final legislation reflects a balance of interests.

The Senate President, Godswill Akpabio assured Nigerians that all submissions would be objectively considered. He encouraged stakeholders to engage constructively, saying, “This process is not about silencing dissent but about ensuring that the best outcomes are achieved for our economy and people.”

Political Will and Challenges in Implementation

The success of the tax reforms hinges on the political will of both the legislature and executive arms of government. While Godswill Akpabio’s leadership underscores a determination to see the bills through, the road to implementation may encounter resistance from vested interests.

Challenges such as bureaucratic inefficiencies, potential legal disputes, and public skepticism could hamper progress. Analysts have urged the government to complement legislative efforts with robust advocacy campaigns and institutional reforms to ensure seamless execution.

Tax Reforms: A Catalyst for Nigeria’s Economic Transformation

The successful implementation of the tax reform bills has the potential to redefine Nigeria’s economic trajectory. By streamlining revenue collection processes and broadening the tax base, the government could unlock substantial funds to invest in critical infrastructure, healthcare, and education. This shift would reduce the nation’s dependence on external borrowing and help stabilize public finances. Additionally, a more robust tax system could enhance service delivery, fostering economic growth and improving citizens’ quality of life.

However, realizing these benefits requires a strategic and inclusive approach. Addressing public concerns, ensuring transparency, and creating an equitable taxation system are essential to gaining citizens’ trust. Senate President Godswill Akpabio’s unwavering commitment to the reforms reflects the political will needed to navigate these complexities. His leadership could be instrumental in achieving a balanced framework that aligns with Nigeria’s development goals while minimizing the burden on taxpayers. This pivotal moment could set the foundation for a more sustainable and prosperous economic future.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.