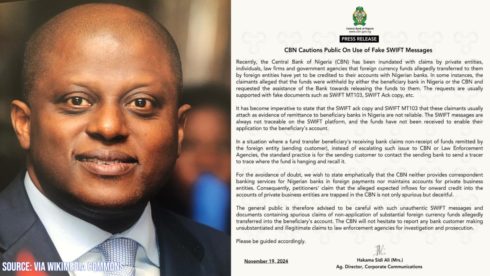

The Central Bank of Nigeria (CBN) has raised alarm over the discovery of fraudulent schemes involving the manipulation of SWIFT (Society for Worldwide Interbank Financial Telecommunication) messages. These scams, which exploit the global financial communication system, are designed to deceive individuals and businesses into unauthorized transactions. The fraudsters create counterfeit SWIFT messages, making their activities appear legitimate to unsuspecting victims.

CBN officials highlighted that these fraudulent messages often resemble genuine financial communications, including payment instructions and account balance confirmations. The central bank emphasized the sophistication of these scams, which target both financial institutions and their customers, posing significant risks to the integrity of Nigeria’s financial ecosystem.

Public Urged to Exercise Caution

In response to these developments, the CBN has issued a strong advisory urging Nigerians and the general public to remain vigilant. The central bank called on individuals and businesses to scrutinize financial messages, particularly those requesting sensitive information or authorizing transactions. Awareness and caution, they stressed, are the first lines of defense against falling victim to these schemes.

To help the public identify and report such activities, the CBN has provided guidelines on verifying the authenticity of financial communications. These include contacting the purported sender directly via official channels and avoiding clicking on suspicious links or attachments. The bank reiterated its commitment to ensuring a secure and trustworthy financial environment for all Nigerians.

Financial Institutions: A Call for Heightened Security Measures

The CBN has also directed financial institutions to implement enhanced security protocols to detect and prevent fraudulent SWIFT activities. Banks and other financial service providers are urged to invest in advanced fraud detection systems, conduct regular employee training, and improve customer awareness campaigns.

The central bank emphasized the need for a collaborative approach among stakeholders in the financial sector to combat the increasing sophistication of cybercriminals. By sharing intelligence and adopting proactive measures, financial institutions can play a pivotal role in safeguarding the financial system from emerging threats.

Legal Consequences for Perpetrators

As part of its response, the CBN has vowed to work closely with law enforcement agencies to track and prosecute individuals involved in these fraudulent activities. The central bank emphasized that creating false SWIFT messages constitutes a severe crime with penalties that may include hefty fines and imprisonment.

The CBN called on members of the public who have fallen victim to such scams to report incidents promptly to their financial institutions and the appropriate authorities. This, they noted, will aid investigations and deter future criminal activities.

Educating the Public: An Essential Strategy

Recognizing the importance of public awareness, the CBN is intensifying efforts to educate Nigerians about the risks associated with fraudulent SWIFT messages. Through public campaigns, social media advisories, and collaborations with financial literacy organizations, the central bank aims to equip citizens with the knowledge to identify and avoid scams.

These educational initiatives are designed to empower individuals and businesses with the tools to safeguard their financial transactions. The CBN also emphasized the importance of staying informed about emerging fraud trends to reduce vulnerabilities within the financial ecosystem.

Safeguarding Nigeria’s Financial Ecosystem

The detection of these fraudulent schemes underscores the evolving challenges in maintaining the security of Nigeria’s financial system. The CBN reaffirmed its commitment to leveraging technology, policy enforcement, and public cooperation to address these threats.

By adopting a multi-pronged approach, the central bank aims to enhance the resilience of Nigeria’s financial infrastructure. The CBN reassured Nigerians that it remains steadfast in its mission to protect their financial interests while fostering a secure environment for economic growth and development.

Table of Contents

Discover more from OGM News NG

Subscribe to get the latest posts sent to your email.